Crawford corporation incurred the following transactions – Crawford Corporation’s transactions provide a comprehensive insight into the financial activities and performance of the company. By examining these transactions, we can gain valuable insights into the company’s financial health, operations, and overall strategy.

The following Artikel presents a detailed analysis of Crawford Corporation’s transactions, covering various aspects such as transaction analysis, classification, financial impact, documentation, and internal controls.

Crawford Corporation’s Transactions: Crawford Corporation Incurred The Following Transactions

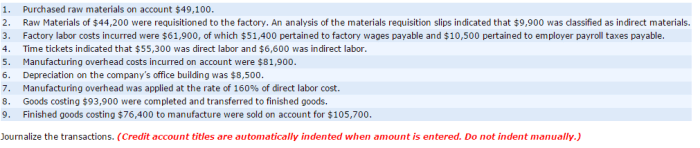

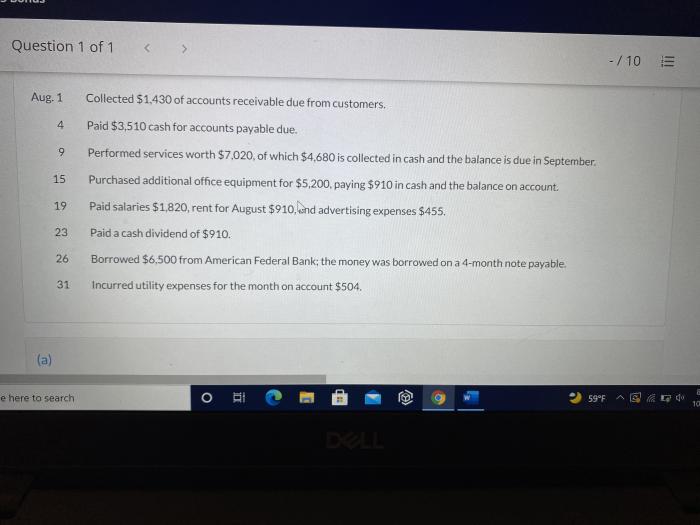

Crawford Corporation incurred the following transactions during the year:

- Purchased inventory on account for $100,000.

- Sold inventory for cash, generating revenue of $150,000.

- Purchased equipment for cash, costing $50,000.

- Issued common stock for $20,000.

- Paid salaries to employees, totaling $30,000.

- Declared and paid dividends to shareholders, amounting to $10,000.

These transactions have a significant impact on the company’s financial position, as they affect its assets, liabilities, and equity.

Transaction Analysis

The transactions can be analyzed using the following accounting principles:

- Revenue Recognition Principle:Revenue is recognized when goods or services are provided to customers.

- Matching Principle:Expenses are matched to the revenues they generate.

- Going Concern Principle:The company is assumed to continue operating in the foreseeable future.

These principles help ensure that the transactions are recorded accurately and consistently.

Transaction Classification

The transactions can be classified into the following categories:

- Operating Activities:Transactions related to the company’s primary operations, such as purchasing inventory, selling products, and paying salaries.

- Investing Activities:Transactions involving the acquisition or disposal of long-term assets, such as purchasing equipment.

- Financing Activities:Transactions involving the issuance or repayment of debt or equity, such as issuing common stock or paying dividends.

This classification helps users of the financial statements understand the nature and impact of the company’s transactions.

Financial Impact

The transactions have the following impact on Crawford Corporation’s financial position:

| Account | Beginning Balance | Transaction Impact | Ending Balance |

|---|---|---|---|

| Cash | $0 | $150,000 (revenue)

|

$60,000 |

| Inventory | $0 | $100,000 (purchase) | $100,000 |

| Equipment | $0 | $50,000 (purchase) | $50,000 |

| Common Stock | $0 | $20,000 (issuance) | $20,000 |

| Retained Earnings | $0 | $150,000 (revenue)

|

$110,000 |

The transactions result in an increase in the company’s cash, inventory, equipment, and common stock, while retained earnings increase.

Transaction Documentation

Proper documentation of transactions is essential for the following reasons:

- Accuracy:Documents provide evidence of the transaction and help prevent errors.

- Accountability:Documents assign responsibility for the transaction and provide a basis for internal controls.

- Legal Compliance:Documents may be required by law or regulations.

Examples of supporting documentation include invoices, purchase orders, bank statements, and contracts.

Internal Controls, Crawford corporation incurred the following transactions

Internal controls are designed to prevent and detect errors or fraud related to transactions. Some specific procedures that can be implemented include:

- Segregation of Duties:Different individuals should handle different aspects of a transaction, such as authorization, recording, and custody of assets.

- Authorization:Transactions should be authorized by an appropriate authority before being executed.

- Verification:Transactions should be independently verified to ensure accuracy.

- Reconciliation:Records should be reconciled regularly to identify any discrepancies.

These procedures help safeguard Crawford Corporation’s assets and ensure the reliability of its financial statements.

FAQ Compilation

What are the different types of transactions incurred by Crawford Corporation?

Crawford Corporation incurs various types of transactions, including operating activities, investing activities, and financing activities.

How do Crawford Corporation’s transactions impact its financial statements?

The transactions impact Crawford Corporation’s financial statements by affecting the company’s assets, liabilities, and equity.

What are the key internal control procedures implemented by Crawford Corporation?

Crawford Corporation implements various internal control procedures, such as segregation of duties, authorization controls, and reconciliation procedures, to safeguard its assets and prevent fraud.